The church of recurring revenue

Plus: A conversation with Big Cabal CEO Tomiwa Aladekomo

Subscription models are attractive because they’re clean. They’re an “honest business model,” as one exec put it during a recent private dinner The Rebooting hosted. They’re a forcing function for a company to align its operations with its customers.

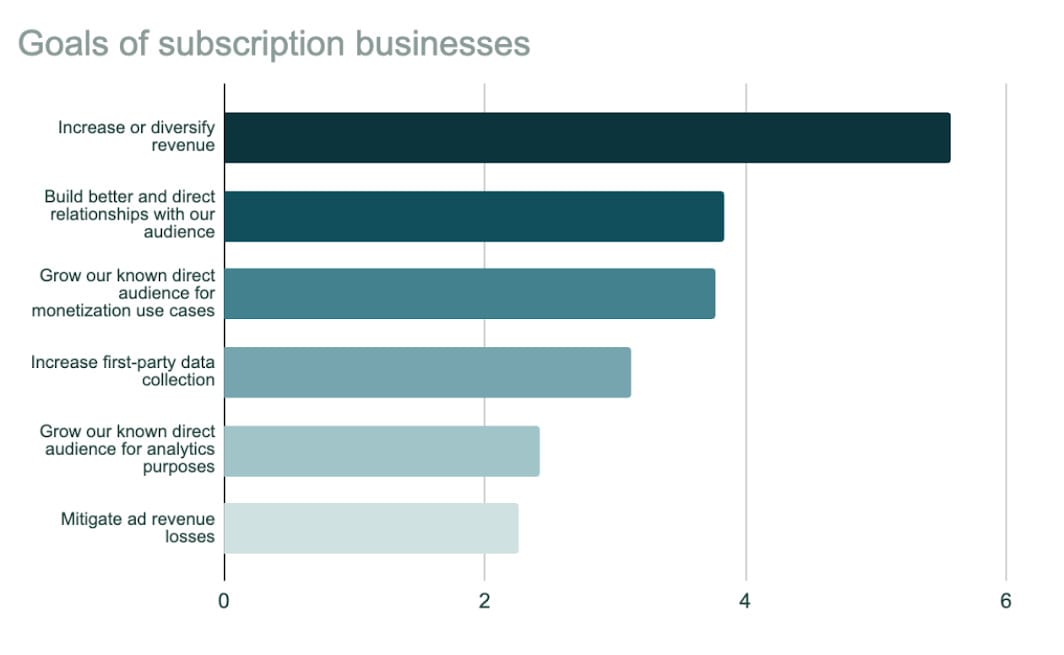

The reality is, of course, messier and uneven. The recent research study The Rebooting undertook with BlueConic showed this. The main goal of subscriptions programs is simple: revenue not alignment.

Even the most honest of subscription programs become dominated by optimization exercises that often force choices of what is best for the business and what’s best for customers. Is dangling a $1/month intro offer and then staying quiet when it rises 30x aligned? How about call to cancel? In a truly aligned model, every customer would get a notice ahead of renewal with an easy option to decline. That doesn’t happen, at least not for many publishers. You just get the receipt or your card is hit. The reality of subscription programs is over 40% of subscribers are usually sleepers, aka people paying for a product they don’t use.

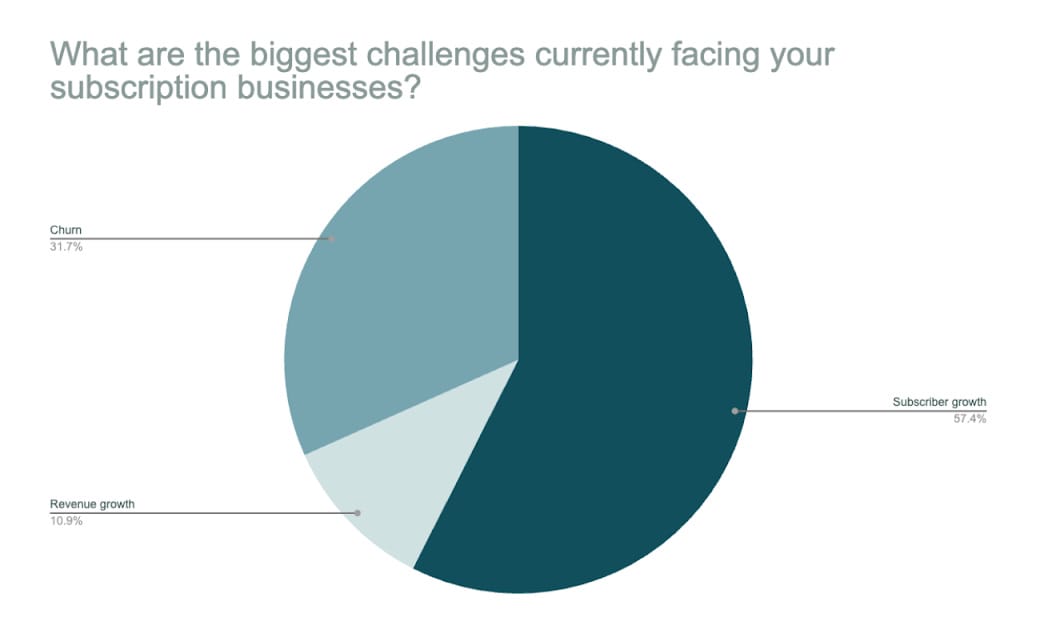

Publishers typically fall into fighting a two-front war to get people in the door and keep them from leaving.

Trends never last. I don’t think subscription services are going anywhere, but I do think the market will struggle with so many that are built on a recurring model. The benefits of recurring subscriptions pool completely on the side of the seller. Many streaming services are already seeing a deterioration. Lucas Shaw at Bloomberg detailed this in Screentime:

This is how markets work. The anecdotal evidence of subscriptions fatigue will eventually show up in the numbers. In the spirit of always betting on things that don’t change, bet on companies going overboard with trends and flooding the market with too much.

In streaming, that’s led to a regular behavior of turning subscriptions on and off. It’s a pain to manage – friction! – so streamers have seen it as a cost of doing business. Publishers see this behavior to a lesser degree, but plenty of people dip in and out on intro offers. For all the talk of relationships, that behavior is a market signal that many customers want more flexibility, not less.

37signals is often good at picking up market shifts. It is rolling out an antidote to SaaS subscriptions models with Once, which is a heretic to what it calls the “Church of Recurring Revenue” by selling software the old fashioned way: pay once and host the software. Just because software isn’t sold in a box doesn’t mean it has to be a subscription. “The post-SaaS era is around the corner,” promises Jason Fried, CEO of 37signals.

More publishers will adopt flexible subscriptions. Before I get a message from every micropayments system under the sun, yes, the time might finally have arrived. There will be more one-off payments for discrete products. Look at the path taken by Barstool, which is now freed from Penn but also in need of an independent business model when its ad business will always have a ceiling because of all the things Elon Musk rails against. Rather than a broad subscriptions program, Barstool is selling season passes to “Surviving Barstool,” a reality TV show that based on the highlights clips is not made for me. According to Barstool founder Dave Portnoy, 57,000 people have bought a $10 pass to view the show. It has a growing stable of pay-per-view products.

In many ways, this is an even more honest model. Because the downsides of one-time transactions is you need to keep earning them rather than benefiting from the inertia of customers who are no longer using your product but continue to pay for it.

For more on the state of subscriptions at publishers, check out “The State of Publisher Subscriptions.”

Big Cabal’s Tomiwa Aladekomo on mobile-first media

On this week’s episode of The Rebooting Show, I spoke to Tomiwa Aladekomo, CEO of Big Cabal, a Nigerian digital media company that’s home to a pair of properties: Tech Cabal, which I describe as similar to TechCrunch but with more memes and Zikoko, a BuzzFeed-like culture publication.

Big Cabal has raised $2.3 million in venture capital as it builds an independent digital media company in Africa’s largest economy. Tomiwa and I discuss how Big Cabal looks to find white spaces in the market, making hard calls when to pull back on efforts like it recently did with a citizen journalism project, when brands can be pan-African vs market specific, and an on-the ground assessment of the impact of Semafor in its Africa push.

Listen to The Rebooting Show on Apple, Spotify or other podcasting services.

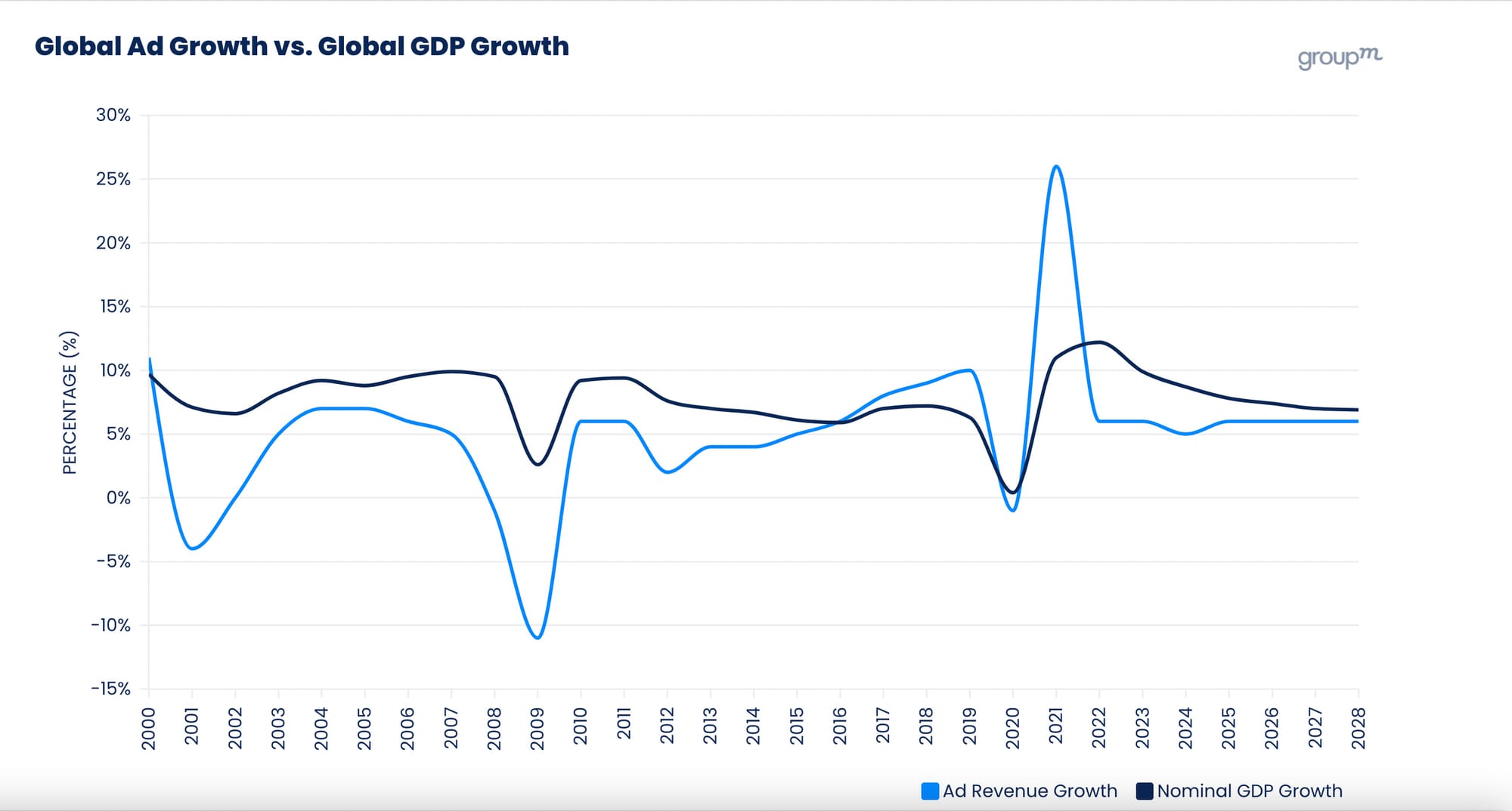

The post-pandemic hangover

The ad market appears to be stabilizing. Forecasts are calling for robust growth for next year. The big unknown is how much of that will reach publishers with so much upheaval in distribution, ad signals and a broad shift to the type of performance marketing better done by platforms and retail media. This GroupM chart highlighted just how unusual a year 2021 was:

Thanks for reading. Send me feedback by hitting reply. For sponsorships, check out The Rebooting’s programs for 2024 and get in touch. Looking forward to expanding our Dinner Series with partners that are helping create a sustainable and resilient media ecosystem.