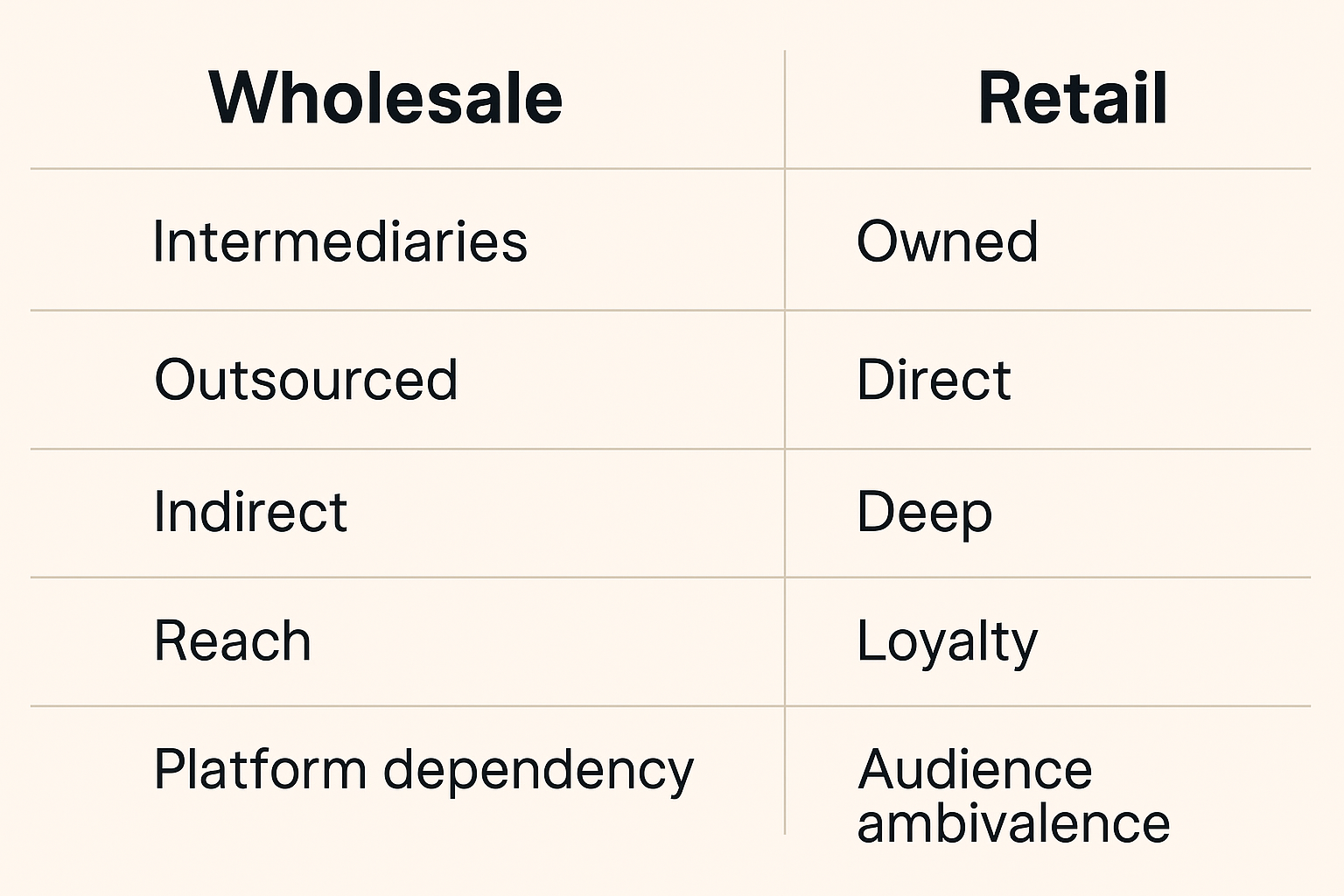

Wholesale vs retail

Media companies are scrambling to go DTC

Welcome back to The Rebooting. This week, I wrote about something I’ve been noodling for a while: The differences between operating a wholesale and retail business. Almost all of my conversations with media operators who are not starting from scratch quickly land on the difficulties of operating the old model while building the new model. I see that happening between wholesale and retail.

- Be sure to check out our new research done in collaboration with BlueConic. This project centered on twin shifts in media businesses: Adopting AI and adopting audience-centric business models. A recurring theme of all of our research ends up being how the organizational silos inherent in publishing businesses are holding them back in their transition. Getting that right will be critical to building thriving and sustainable models. Download the research.

- Simplifying the tech stack is an unglamorous but critical step in focusing these businesses on what differentiates them. Aaron Segal, head of product and engineering at Recurrent, home to Popular Science, The Drive and Futurism, will get into the details of how Recurrent migrated its tech stack recently and positioned the publisher not just for efficiency but for growth as well. Join our Online Forum with Aaron on Wednesday, May 21, at 1pmET. A replay and cheat sheet with takeaways will be sent to anyone who registers. Register now.

- We have a lot going on lately at TRB. This is the Busy Season that runs through Cannes before a summer lull and a second Busy Season in the fall as Q4 kicks off. We’re putting the final touches on our plans there, including a series of live podcast gatherings. I’ll have information on those next week. As a reminder for preferred access to all of The Rebooting’s gatherings, including our seris of private dinners, upgrade to TRB Pro for $200 per year or $20 per month. I know I’ve said this previously, but we are for real adding both virtual and in-person gatherings to the offering. The Media Product Forum we held last week with WordPress VIP reinforced to me that congregation is critical. Upgrade to TRB Pro.

Building a unified audience view

Data silos and disconnected systems remain a core obstacle to personalization and performance. This session will dig into the trade-offs publishers face between centralization and flexibility and what it really takes to achieve a unified audience view.

- How publishers are tackling siloed data across audience, content, and commerce systems

- The pros and cons of overhauling vs. integrating your martech stack

- Whether a 360-degree view of the audience is realistic—or even necessary

Wholesale vs retail

The truism of media is it sucks to be caught in the media. Media companies are stuck in an uncomfortable place. For decades, wholesale ruled. Cable networks got paid through carriage fees. Digital publishers relied on platforms for traffic and automated systems for ads. But that world is shifting, if not collapsing. A new model is taking hold as publishers increasingly shift to retail models vs being wholesalers.

The wholesale model and the retail model are fundamentally different in how they make money, build audiences, and measure success. The retail media is more akin to DTC media.

Whether they admit it or not, most media companies are stuck somewhere in between. They rely on wholesale economics but want retail outcomes. As Parquor’s Andrew Rosen has noted to me in 2023 , many executives are counter-incentivized to innovate. They are paid to preserve the old model, not build the new one. That is starting to change, but slowly, with the needs to continue feeding the old model often slowing the building the new one.

Start with Warner Bros. Discovery. The company rebranded HBO Max as simply “Max.” It dropped one of the most valuable brands in media. The pivot was meant to broaden the platform’s appeal. It ended up confusing the audience and weakening the brand. The jokes about Dr. Pimple Popper being uneasily aside the prestige TV of HBO rang true. As Vulture noted, “Max” was supposed to be a general entertainment hub. In reality, it stripped the service of its cultural cachet. “It’s not TV, it’s HBO” meant something more than a catchy slogan. Now, the company is reversing course. The Max experiment failed. At least its social media managers are having fun with it. Less fun: it revealed how hard it is to retrofit a wholesale business into a retail one.

CNN tells a similar story. The spectacular failure of CNN+ was followed by silence. WBD has now reentered the streaming space. Its big play? A CNN weather app. Axios described it as an attempt to reconnect with core brand trust. CNN’s audience has dwindled. Cable news formats are tired and losing out on YouTube, the new TV, to video podcasts from digitally native personalities.

The big test is whether CNN can shift to a retail model that CEO Mark Thompson has been promising for an awfully long time and will finally launch in the fall. Getting traction is hard enough without having to hedge in order to protect legacy distribution through cable operators. There is no appetite for burning the boats.

Even Disney is hedging. ESPN is finally going direct-to-consumer. But the launch is tied up in complexity. The company is now offering a Disney-Hulu-ESPN bundle with a 20 percent markup. It’s an admission that it can’t quite let go of the old model. And the world of mini-bundles is making the old cable model look more attractive to consumers. Substack is a runaway success of DTC media, without a doubt, but really, how many newsletters will people pay for? It’s a valid question despite Substack continuing to prove the ceiling is higher than many, including me, expected. Unbundled media has become something like a tapas restaurant. Lots of side dishes offered as a markup that leaves you wanting just a regular meal.

This shift is not limited to streaming. It’s happening in publishing too. For years, digital publishers were essentially wholesalers. Google and Facebook provided distribution. Ad tech firms handled monetization. The goal was to generate as much reach as possible. But that model is under pressure. Search referrals are declining. Safari searches dropped for the first time in 22 years, according to Eddie Cue. AI interfaces are changing how people find information.

Publishers are now scrambling to build direct relationships. That’s easier said than done. Most haven’t invested in CRM systems or customer service. They haven’t built the operational muscle. The New York Times did, but it started more than a decade ago. Everyone else is trying to catch up. Dotdash Meredith recently launched a standalone People magazine app. It’s staffed by 65 people. It’s a big bet that consumers want another app on their phones—and will return to it. Adweek has more.

Henry Blodget, co-founder of Business Insider, offered some useful context in a recent conversation. He framed the digital media timeline in phases. First came the desktop wave. Then mobile and social. Now we’re in the consolidation era. “This era is about building owned and operated channels,” Henry told me this week in a recording for an upcoming episode of The Rebooting Show. “Email, apps, homepages. That’s where the durability is.”

Email newsletters are powerful, but they can also limit growth. Many of these businesses are small, and most will stay that way. YouTube is proving to be a more flexible platform. It gives creators access to massive audiences. But it also lets them build direct lines of business. Events. Merch. Memberships. It offers a balance that looks increasingly attractive.

A good example of how this hybrid model works in practice is Good Good Golf. The brand uses YouTube as its primary wholesale distribution platform, with videos regularly surpassing one million views. But that attention is just the starting point. The real business is retail. According to its investor materials, 73% of Good Good’s revenue comes from direct-to-consumer product sales—primarily apparel and gear. Another 14% comes from YouTube ads and 6% from sponsorships, while retail partnerships like Dick’s Sporting Goods now account for 7%.

This is what a modern media flywheel looks like: content drives culture, culture drives commerce, and commerce funds content. This is the kind of media business of the future: It’s a brand.

Still, something I’ve been considering lately is how many publishers may end up fully embracing the wholesale model—because they have no other viable choice. A new class of buyers has emerged for distressed digital media properties. These are the harvesters. As Anonymous Banker put it on the last episode of People vs Algorithms, “They’re operators, not dreamers.” These companies – Static Media, Valnet, Savage Ventures, Regent – aren’t chasing awards or equity stories. They cut headcount, outsource editorial, and pump content into algorithmic smelters. “It’s like running a chemical plant,” he said. “Low-margin, low-growth. But if you buy right and run lean, you make money.”

At the Media Product Forum earlier this month, these tensions surfaced repeatedly in our roundtable discussions. There was a clear consensus that everyone sees the shift coming—but no one quite feels prepared. As one product leader put it, “Nobody has this figured out. The ambition-execution gap is real. We’re talking about AI strategy, but still scrambling to maintain basic workflows.” Another noted that despite the enthusiasm for direct models, most teams are still structured around platform-era incentives and legacy tech decisions. The cost of bridging that gap is often cultural as much as operational.

If there’s a nightmare scenario for legacy media operators, it’s the disappearance of Google Discover. AI chatbots replacing a meaningful share of search—some projections put it at 30 to 50 percent—would be catastrophic. As Neil Vogel has noted, the old content is gone. They have it, and they’re not giving it back. That’s why some publishers are cashing the checks now. They’re hoping the damage comes later. Few can afford the New York Times’ path of litigation.

Publishers are investing in AI mostly on the infrastructure level. According to a recent research report from The Rebooting and BlueConic, 58% of publishers are already using or planning to use AI for audience insight, but just 5% say they’re very effective at personalization. The tools are improving. The organizational structure is not. Fragmented systems, unclear ownership, and cultural mistrust remain major blockers. Check out the full research for more.

The strongest players in digital media today aren’t publishers. They’re brands. A brand lets you escape the broken monetization mechanics of digital media and the fragility of outsourced distribution that you don’t control. Brands can be monetized in many ways—ads, yes, but also events, commerce, memberships, licensing, and partnerships. That’s why Newsweek is a growing business again. It isn’t because it’s pining for a return to its days as a weekly news magazine. It’s because it has accepted that its future lies in being a brand that is monetized across multiple channels, even as it operates a traffic based model.

A similar transition is well underway at its former archrival, Time. The company is repositioning itself from a generalist news publisher to what it now calls a “platform for business decisionmakers.” It’s leaning into B2B services, longevity franchises, and branded experiences aimed at corporate leaders. That’s not a pivot back to prestige print. It’s a redefinition of what a media brand can be in this era—asset-light, audience-focused, and channel-agnostic.

Still, there is reason for optimism. In that same conversation, Henry offered a hopeful view of the work ahead:

“The good news is it's a much more durable relationship. If you can do it, it's like subscribing to a newspaper and you're building something of incredible value that you control.”

Thanks for reading. Send me feedback by hitting reply.