Reasons for optimism

Finding pockets of energy

Today’s newsletter finds the many reasons for optimism about the media business. First up: new data from The Rebooting’s latest research project about how the decline in search referrals is accelerating shifts in publisher business strategies, and a conversation with Essentially Sports’ Suryansh Tibarewal on how it is navigating distribution challenges and diversifying revenue.

Join TRB Pro for full access to all of The Rebooting’s content as well as invitations to virtual and in-person member events. I’ll have an update on my plans for membership in a few weeks to mark the fifth anniversary of this newsletter (crazy to think). I’m going to keep adding value to it as a tool for media professionals to stay ahead as they do the essential work of building sustainable business models. Upgrade if you haven’t already. Appreciate it.

The post-SEO future

The more-with-less era has arrived for publishers. The SEO gravy train has derailed, if stabilized. I recorded a podcast with Forbes CEO Sherry Phillips yesterday, and she told me Forbes has seen declines of 30-40%. Ouch.

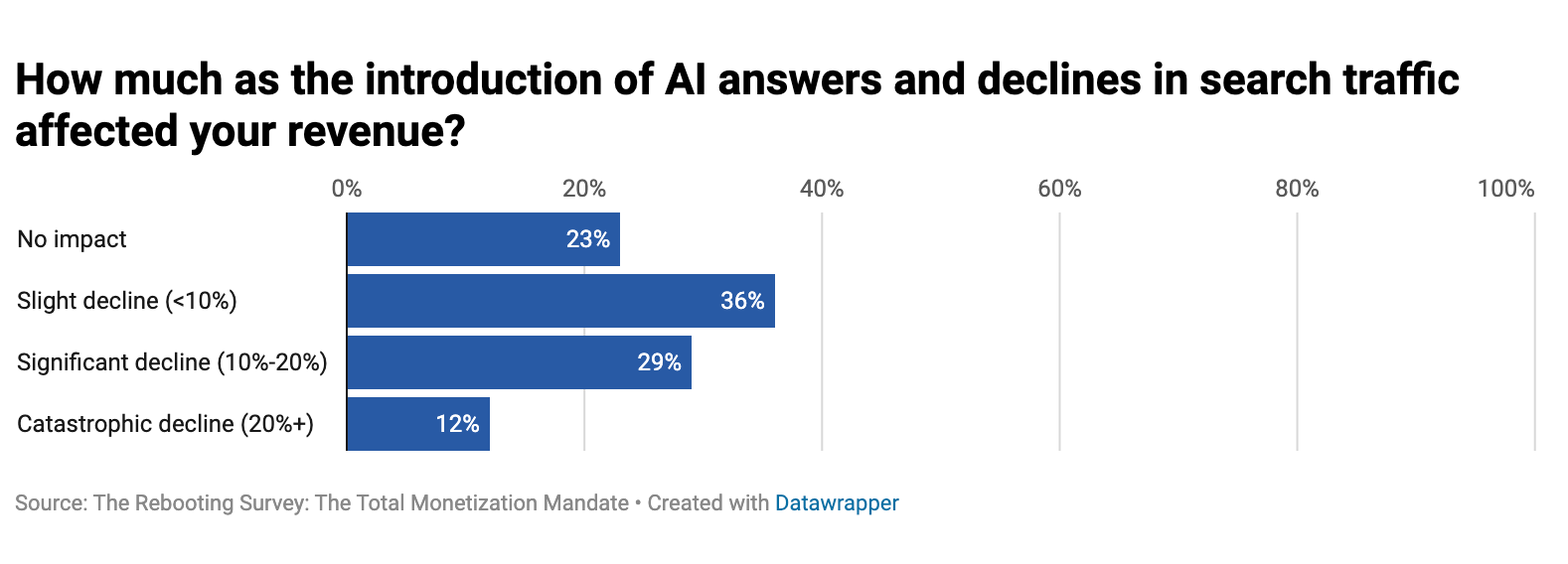

That’s forcing publishers to accelerate their overhaul of business models to emphasize more durable relationships with the audience. In The Rebooting’s latest research report, done in collaboration with Piano, we surveyed revenue leaders and found 41% of publishers have seen search declines of 10% or more. In response, 59% are implementing first-party data strategies.

“Let’s start from a place of loyalty, James Denis, CRO at Sherwood News, told us. “That becomes our foundation. If we can maintain a strong subscriber base and high open rates, the platform changes matter a lot less.”

Added Michael Silberman, evp of media strategy at Piano: “The publishers that have pivoted away from a mass-attention model toward a deeper engagement strategy are going to be more resilient. Engagement, rather than raw reach, is the key to sustainable growth.

Thanks to Piano for its support in creating this research report. Piano’s Digital Revenue Optimization solution helps digital services grow revenue by better understanding and influencing their customers’ behavior. Piano unifies analytics, segmentation, and commercial personalization in one AI-driven application, enabling sites and apps to efficiently maximize the value of every user visit. For more information, visit piano.io.

How Essentially Sports navigates shifts

This week, I spoke to essentially sports cofounder Suryansh Tibarewal about how it is adapting its strategies in a time of traffic flux. Essentially sports is a high volume web publisher, one i’d consider as a classic pageview publisher. Suryansh and I discuss how essentially has continued to benefit from Google Discover, shifting its business model to focus more on direct sold revenue rather than programmatic and how its fan perspective is a differentiator in a crowded category.

Reasons for optimism

In our latest episode of People vs Algorithms, Troy took a step back and gave a slew of reasons to have optimism about the future direction of the media industry, notwithstanding the many cases of decline of once storied brands that have reached what Troy calls “the harvesting stage.” (I prefer hospice care, which has replaced the SEO glue factory.)

Both are, of course, true. Depending on the room you’re in, there’s either tremendous energy and growth or grim gallows humor about riding out yet another existential crisis – and whether this is the one that will truly be the big one. I find this bifurcation fascinating.

There’s no single thread that connects the models that are working – and crucially have energy – but commonalities fall in the boring but hard category: strong audience ties, diverse business models that rarely depend on standardized digital ads, narrow and deep focus areas, wealthy audiences, content beyond the webpage, and human approaches that stand as a counterpoint to synthetic slop. More than anything, media continues to attract talented individuals that supply it with the needed energy to create a better Information Space

The big guys are fine. The New York Times, Bloomberg Media, The Wall Street Journal and The Financial Times are not on the cusp of extinction. In fact, many are thriving. The New York Times is under attack by an activist investor mostly because it hasn’t capitalized enough on its many advantages. It’s subscriber base has topped 11 million as its bundle strategy has succeeded. It might not have Netflix-like ceiling but there’s no evidence its expansion will stall. Business publishers are benefiting from AI in the form of ad spending. The Wall Street Journal has a renewed energy in its coverage.

Publishers are becoming talent managers. The energy in media is with individual creators, without a doubt, but institutional publishers are no longer seeing this as a threat. Vox Media is a prime example of a publisher that is marrying talent with its infrastructure and deep brand relationships. The Wall Street Journal is building a “talent lab.” ESPN and Fox are implementing talent-focused strategies. NYT-owned sports brand The Athletic has a distribution deal with independent YouTube star Pablo Torre, host of Pablo Torre Finds Out.

Niche brands are thriving. The renewed energy in niche magazine brands is a signal that as AI floods feeds with synthetic content – even the human-created content on X feels synthetic to me, with its manufactured outrages that have created a cesspool – the biggest opportunity is not to try to out-AI AI but offer more human alternatives. These brands are smaller and often serve a different economic purpose with events and activations at their core. Synthetic content will be like fast food: satisfying in the moment but unhealthy in the long term. I continue to believe that constant consumption of AI slop will never be seen as cool, and tech people always underrate the impact of culture because their engineering brains don’t make room for it.